How Metal Finishing Leaders Face Supply Chain Challenges in High Rates

…..many metal finishing companies are bracing for the next economic triad – i.e., massive commodities super cycle, high interest rate effect, and continuing supply chain limitation.

Automotive sector’s electrical vehicle (EV) push is changing the commodities market. The change had and will continue to affect metals like copper, aluminum, nickel, etc. Albeit, it has been only a year since the balance tilted, make no mistake, the commodities huge super cycle had just begun.

Executives can be sanguine about their business once they levitate with a two-year picture on the economic triad of interest rate, commodities price and supply chain.

Over a year, supply chain woes affected the global economy and the surface & metal finishing industry. These challenges, mostly related to ocean freight imports and semiconductor chip shortages, were driven by COVID – 19.

A few companies have negated these challenges and many are bracing for the next economic triad – i.e., massive commodities super cycle, high interest rate effect, and continuing supply chain limitation.

This paper gives background, specifics and recommendations.

Supply Chain

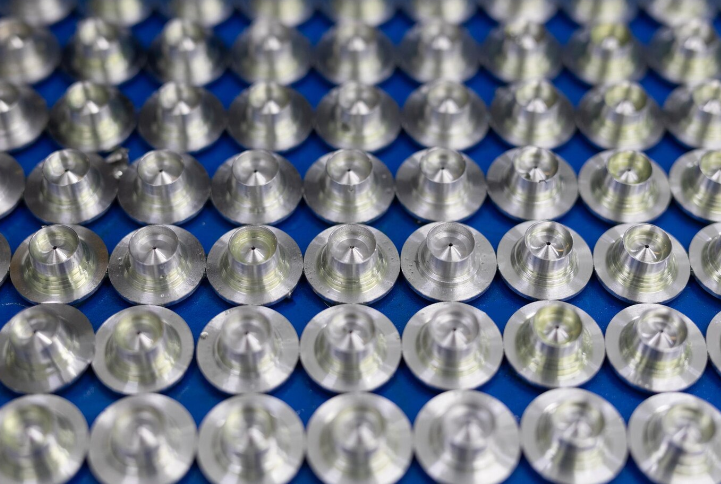

DC rectifiers used in electroplating and anodizing applications were among many products affected by semiconductor chip shortage and ocean freight bottleneck. Automotive sector is one of the worst affected because of these issues.

Automotive sector’s electrical vehicle (EV) push is changing the commodities market. The change had and will continue to affect metals like copper, aluminum, nickel, etc. Albeit, it has been only a year since the balance tilted, make no mistake, the commodities huge super cycle had just begun.

Electroplating companies need these metals either as anodes or as salts.

Advint recommends its clients to work only with suppliers who have negotiating powers, and negotiate the price with them. Prices are volatile, but a supplier can balance delivery with price at a fair profit margin. It is important to keep a bill of materials (BOM), cost of goods sold (COGS) system, and inventory management agile for the foreseeable future.

We expect chips shortage and other supply chain issues to relax from the third quarter of 2022.

High Interest Rate

Many federal and union government’s coffers are empty since they had been on a spending spree through the pandemic. The supply chain issues we discussed earlier had created differences between supply and demand. One must not reminisce about the present crises from the past ones. Earlier global economies were used to demand, not a supply challenge. This pandemic had created supply issue, and the demand continues to be strong. As most are aware, federal reserves have or will soon hike interest rates. This will reduce demand, and advertently or inadvertently, a series of hikes might trigger a recession. If it does not deteriorate to a recession, executives must expect a slowdown in the economy. They must position their finances, inventory management, and allocate the companies’ fixed capital expenditures accordingly. We expect this effect to peak during the second quarter of 2022 and the overall effect of high interest rate environment will last until the end of calendar year 2023.

An Idea in Brief

Higher labour cost, higher commodities price, rapid hikes in interest rate, and persisting supply chain challenges confront metal finishing leaders.

Executives can be sanguine about their business once they levitate with a two-year picture on the economic triad of interest rate, commodities price and supply chain.

Note:

This Insight paper is a redacted version published to Advint’s advisory services subscribers on Jan 03, 2022.

Learn More

Hydrogen Embrittlement: The Hidden Danger Compromising Metal Strength

Posted By:Venkat Raja

Mar 01, 2022

Tags: